Unlock Financial Freedom: Your Comprehensive Guide to Credit Repair

Unlock Financial Freedom: Your Comprehensive Guide to Credit Repair

Blog Article

Recognizing How Credit History Repair Service Functions to Boost Your Financial Health

The process incorporates recognizing errors in credit rating records, contesting inaccuracies with debt bureaus, and discussing with creditors to attend to impressive debts. The concern remains: what certain strategies can people employ to not only fix their debt standing however additionally guarantee long-term financial security?

What Is Credit Rating Fixing?

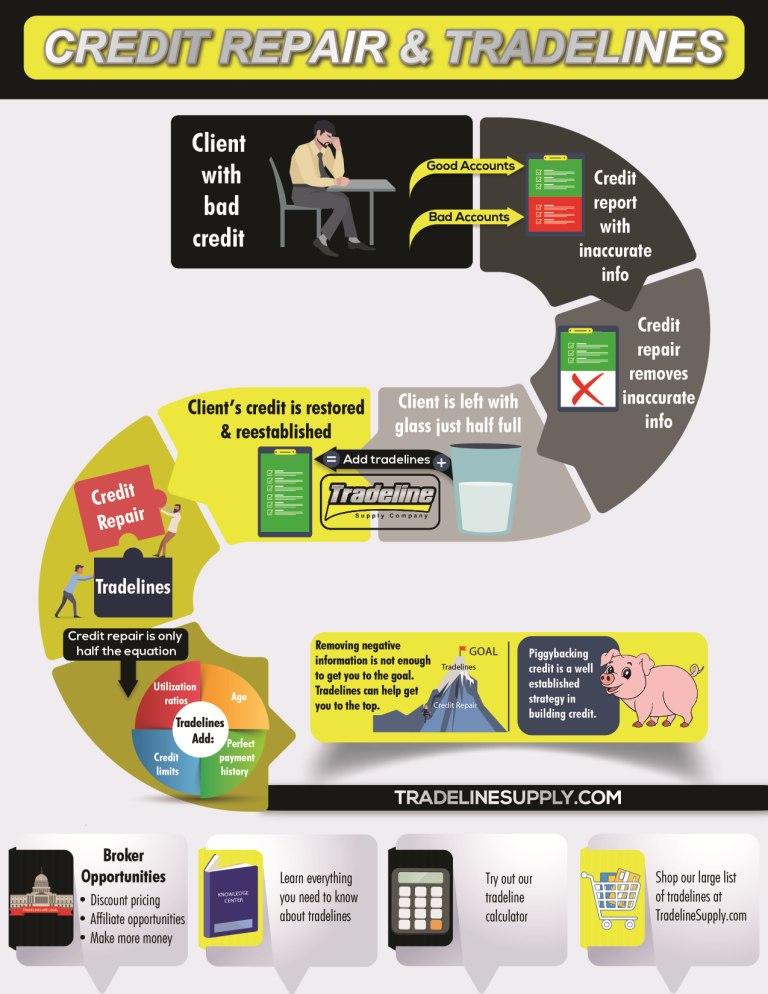

Credit history repair refers to the procedure of boosting an individual's credit reliability by dealing with errors on their credit rating record, working out financial obligations, and taking on better monetary routines. This complex approach aims to enhance an individual's credit report, which is an essential factor in protecting financings, charge card, and positive rates of interest.

The debt repair process generally begins with an extensive evaluation of the person's credit record, enabling for the recognition of any kind of disparities or mistakes. When errors are determined, the specific or a credit history repair work expert can initiate disputes with credit scores bureaus to correct these problems. Additionally, negotiating with creditors to resolve arrearages can further boost one's monetary standing.

Additionally, adopting sensible monetary methods, such as prompt expense payments, lowering credit score use, and maintaining a varied debt mix, adds to a healthier credit profile. Overall, credit score repair work works as a necessary strategy for people seeking to restore control over their financial health and protect better borrowing possibilities in the future - Credit Repair. By taking part in credit scores repair service, individuals can pave the means towards achieving their monetary objectives and enhancing their overall high quality of life

Usual Credit Scores Record Mistakes

Errors on credit history records can significantly influence an individual's credit rating, making it important to comprehend the typical kinds of errors that might arise. One common concern is incorrect personal information, such as misspelled names, wrong addresses, or incorrect Social Safety and security numbers. These errors can cause complication and misreporting of credit reliability.

Another common error is the reporting of accounts that do not belong to the individual, typically because of identification burglary or clerical blunders. This misallocation can unjustly decrease an individual's credit report. Additionally, late payments might be erroneously videotaped, which can occur due to payment processing mistakes or wrong coverage by lenders.

Credit score limitations and account equilibriums can likewise be misstated, resulting in a distorted sight of a person's credit score use proportion. Outdated details, such as shut accounts still appearing as energetic, can negatively affect credit rating analyses. Public documents, including personal bankruptcies or tax liens, might be inaccurately reported or misclassified. Awareness of these typical errors is critical for efficient credit scores monitoring and repair service, as resolving them immediately can help people preserve a much healthier financial account.

Actions to Dispute Inaccuracies

Challenging errors on a credit score record is a crucial procedure that can aid recover an individual's creditworthiness. The initial step includes acquiring an existing duplicate of your credit scores report from all 3 significant credit bureaus: Experian, TransUnion, and Equifax. Evaluation the record thoroughly to recognize any kind of mistakes, such as incorrect account information, balances, or payment histories.

When you have actually identified inconsistencies, gather supporting documentation that substantiates your claims. This may include financial institution statements, repayment confirmations, or correspondence with creditors. Next off, launch the conflict process by getting in touch with the appropriate credit report bureau. You can generally submit disagreements online, through mail, or by phone. When submitting your disagreement, clearly describe the inaccuracies, provide your proof, and include individual recognition information.

After the disagreement is filed, the debt bureau will examine the case, generally within 30 days. Keeping precise records throughout this procedure is crucial find out this here for efficient resolution and tracking your credit health.

Building a Solid Debt Profile

How can individuals successfully grow a durable credit report account? Constructing a solid credit rating profile is important for protecting positive monetary chances. The structure of a healthy and balanced credit rating profile begins with prompt costs settlements. Continually paying charge card bills, fundings, and various other commitments in a timely manner is critical, as settlement history dramatically impacts credit rating.

Furthermore, maintaining reduced credit history utilization proportions-- ideally under 30%-- is important. This indicates keeping credit card equilibriums well below their limitations. Diversifying debt types, such as a mix of rotating credit history (credit rating cards) and installation financings (car or home mortgage), can likewise boost credit report accounts.

On a regular basis keeping track of credit reports for errors is equally crucial. People should examine their credit reports a minimum of each year to identify inconsistencies and challenge any errors immediately. In addition, staying clear of excessive credit report questions can prevent potential negative effects on credit report.

Long-lasting Benefits of Credit Report Fixing

Furthermore, a stronger credit scores profile can facilitate far better terms for insurance coverage premiums and also you can look here affect rental applications, making it simpler to secure real estate. The psychological advantages must not be ignored; individuals that effectively repair their debt commonly experience decreased stress and boosted confidence in handling their financial resources.

Conclusion

To conclude, credit scores repair service acts as a vital system for improving economic health. By determining and challenging errors in credit scores reports, individuals can correct mistakes that adversely influence their credit history. Establishing audio economic techniques better adds to read what he said building a robust credit scores profile. Eventually, efficient credit report repair service not just facilitates access to far better lendings and lower rate of interest yet additionally cultivates lasting economic security, thus promoting overall economic well-being.

The long-term advantages of credit report repair extend far beyond just enhanced debt ratings; they can significantly enhance an individual's overall financial health.

Report this page